January 28th, 2026

New Feature

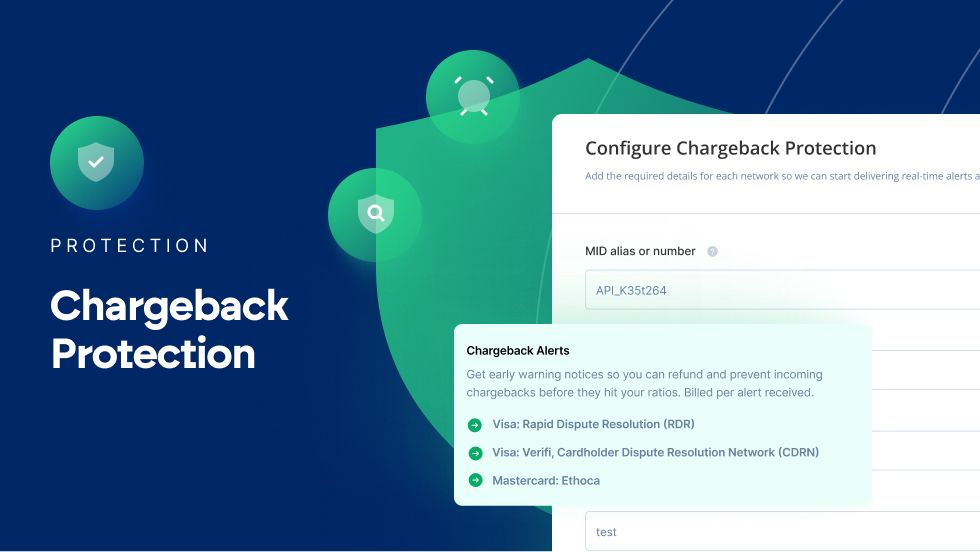

We have introduced a proactive defense suite designed to intercept disputes before they ever become "official" chargebacks. This new feature allows you to resolve customer refund requests during the critical pre-dispute window, preventing damage to your payment gateway health.

What’s New:

Integrated Alert Networks: Direct connectivity with Ethoca, CDRN, and RDR to notify you the moment a dispute is initiated.

Pre-emptive Resolution: New tools to intervene and issue refunds manually or automatically before a chargeback is finalized.

Customizable Automation: Define specific rules based on order value or product type to trigger auto-refunds and protect your account 24/7.

You can now configure these settings under Tools → Chargeback Protection.

Find out more about setting up this option at: https://support.paykickstart.com/en/help/articles/5798267-chargeback-protection-handle-disputes-proactively

January 22nd, 2026

New Feature

Managing your members just got a lot more streamlined. We are excited to announce our official integration with ContentBlocks!

If you use ContentBlocks to manage your projects, you can now automate your fulfillment process directly within PayKickstart. This integration allows you to automatically add new customers to specific ContentBlocks projects immediately after a successful purchase.

What this means for you:

Automated Onboarding: No more manual invites. Your customers get access to their projects the moment they buy.

Seamless Management: Keep your member lists perfectly in sync between your billing and your project workspace.

Better User Experience: Your members get instant gratification with immediate access to their content and tools.

Set Up Your ContentBlocks Integration → https://support.paykickstart.com/en/articles/7710415-contentblocks-integration

January 20th, 2026

New Feature

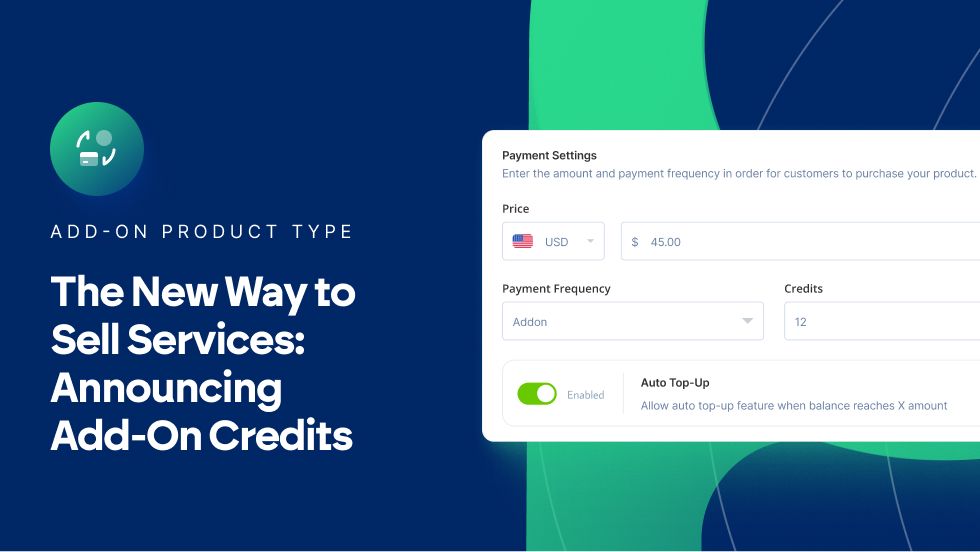

If you sell consulting, coaching, or any service that requires tracking "usage," this feature is for you.

With Add-On Credits, you can now sell pre-paid credits that your customers can consume over time. Whether it’s selling a "5-Hour Coaching Block" or a "Premium Setup Package," managing the balance is now automated and seamless.

Sell Credits: Offer one-time purchases that add specific credit value to the customer’s account.

Track & Manage: View customer balances and manually adjust credits based on usage.

Auto Top-Up: Allow customers to automatically top up their credits once they reach the minimum credit limit.

Customer Visibility: Your customers can view their available credit balance directly inside your own app.

Read the full Add-On Credits Guide at: https://support.paykickstart.com/en/help/articles/0301476-configuring-add-on-credit-based-billing

December 19th, 2025

Improvement

First impressions are important, but the final touch is what leaves a lasting impact.

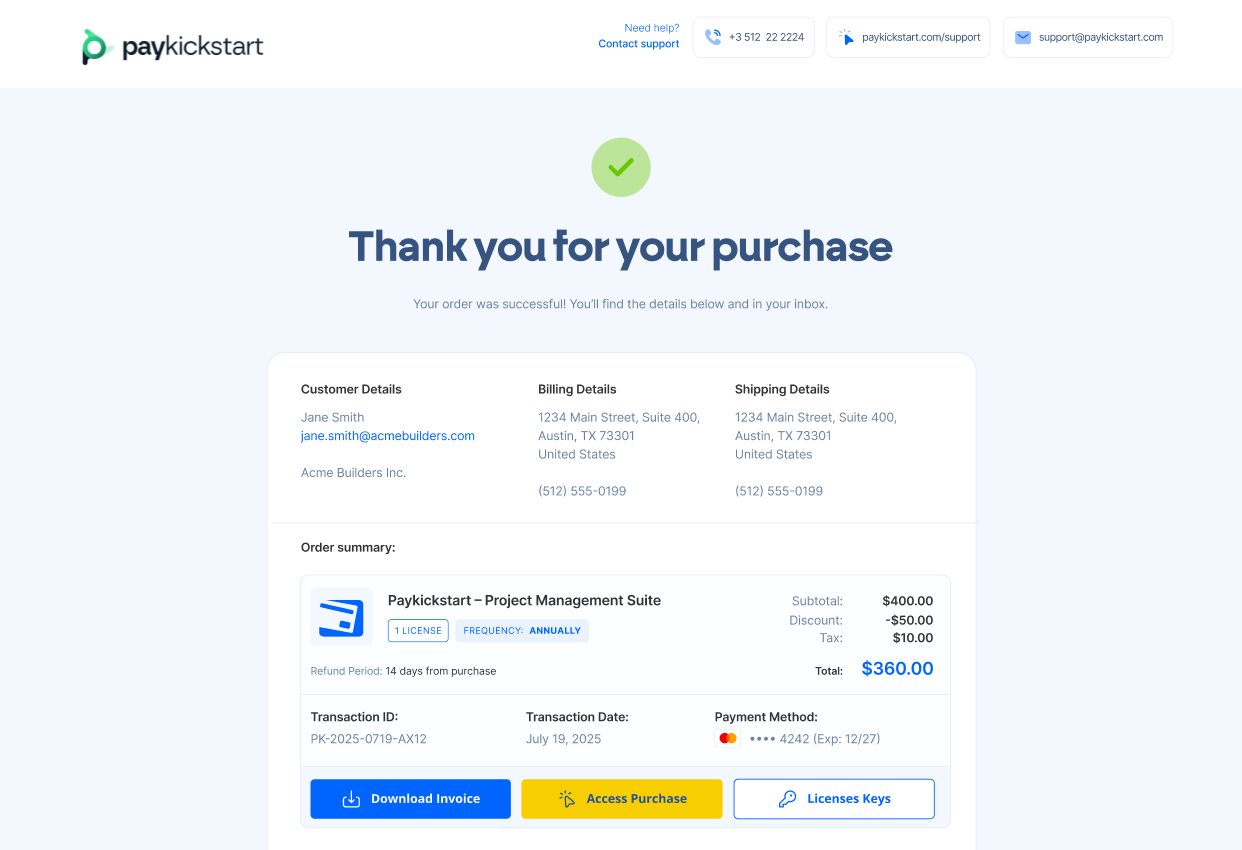

We have completely redesigned the Default Thank You Page to give your customers a polished, professional, and conversion-ready post-purchase experience.

What’s New:

Modern UI: A cleaner, updated look that aligns with current design standards and builds brand trust.

Enhanced Order Summary: As seen in the new design, customer, billing, and shipping details are now organized into a clear, easy-to-read hierarchy.

Actionable Access: We’ve improved the visibility of post-purchase actions. Customers can now easily find buttons to Download Invoices, Access Purchases, and retrieve License Keys right from the summary card.

Automatic Upgrade: If you are currently using the "Default" Thank You page setting, you don't need to lift a finger. Your funnels have already been updated to the new look automatically.

Customization Option: Prefer your own design? You still have full control. You can bypass the default page entirely and redirect customers to a custom URL of your choice in your product settings.

Learn More about setting up Custom Thank You Pages here → 📖 Learn how to use Custom Thank You Pages

December 17th, 2025

New Feature

We have added a powerful new layer of security to your transaction process.

You can now use Pre-Authorization to reserve funds on a customer's credit card without immediately charging them.

This feature allows you to place a temporary "hold" on a specific amount to validate the payment method and ensure funds are available.

You can then "capture" (finalize) the charge later, or void it if necessary.

Why use Pre-Authorization?

Secure Your Trials: Validate a credit card during a Free or Low-Cost Trial sign-up. This ensures the card is legitimate and has funds available, significantly reducing churn from failed payments when the trial ends.

Validate Funds: Ensure high-ticket service clients have the necessary funds available before you begin onboarding.

Once enabled, your customers will have a validation period of reserved funds on their cards, to ensure it is a working card that can be used for their rebills in the future.

Find out all about this option here → 📖 How to set up Pre-Authorization for your Products

December 15th, 2025

New Feature

We are thrilled to announce a major expansion to our Stripe integration designed to unlock global revenue and increase international conversion rates.

We are rolling out support for Local Payment Methods via Stripe! 💜

This update allows you to accept popular, trusted payment options preferred by customers in specific regions, removing friction and building immediate trust at checkout.

Global Coverage is now included: Support for major local payment methods, including AfterPay, Klarna, iDEAL, Giropay, and more.

Our checkout engine intelligently detects your customer's location and currency, automatically displaying the most relevant local payment options for them.

Works natively within your existing Stripe connection, with your Stripe local payment options enabled in your Stripe account.

Customers are significantly more likely to complete a purchase when they see a payment method they recognize and trust. By offering local options, you reduce cart abandonment in non-US markets and open your business to a wider global audience.

🚀 How to Join the Beta: This feature is currently in Open Beta.

To join the beta and help us test this so that we can provide you with the best possible experience, please:

Reach out via the Live Chat inside the app.

Or email us at support@paykickstart.com

Find out more here →📖 Read the complete Knowledge Base Article

August 24th, 2025

New Feature

We're excited to release a new push notification designed to celebrate every piece of revenue our dunning system saves for you!

You can now enable the "Recovered Subscription" alert to get an instant notification sent directly to your device the moment a customer's subscription is saved from cancellation.

Now you can get real-time, positive feedback on your revenue recovery efforts.

When enabled, you'll receive an alert that says: A subscription of $XX.XX was just recovered with dunning! [Subscription ID]

To enable this notification, please visit your user profile settings.

August 20th, 2025

We're excited to introduce a fantastic new feature to the PayKickstart Mobile App, designed to supercharge your sales and streamline transactions on the go! You can now quickly generate and share a QR code for any product directly from your mobile device.

This powerful addition is perfect for live events, pop-up shops, and any scenario where you want to facilitate a seamless, touch-free checkout experience.

How it Works:

Quick Share: In your dashboard menu, go to the Accept Payments section, and select the campaign and product for which you want to generate the QR code.

Scan & Go: Customers can scan the QR code with their smartphone, taking them directly to the product's checkout page for a swift and easy purchase.

Ideal for In-Person Events: Eliminate the need for physical terminals or complex setups at conferences, trade shows, or any face-to-face interaction.

This new mobile feature gives you unprecedented flexibility to capture sales anytime, anywhere. Download or update your PayKickstart Mobile App today and start making in-person checkouts a breeze!

August 18th, 2025

New Feature

Improvement

We are thrilled to announce a major update to our pricing that is designed to help you sell smarter, scale faster, and keep more of what you earn. We're moving to a single, flat-rate pricing model that gives you full access to every PayKickstart feature from day one.

Starting today, you get every powerful tool in the PayKickstart platform for just $79 a month. No more confusing tiers, no locked features, and absolutely no platform transactional fees!

Whether you're just getting started or processing millions in sales, you'll have the full arsenal of PayKickstart features at your fingertips. We believe you should have everything you need to succeed, and this new pricing structure ensures you do.

We've been adding and improving tools to help you grow your business and keep more of what you earn. Here are a few highlights from some of the recent updates we've made to the platform:

New Payment Options

Buy Now, Pay Later: Boost your conversions and average order value by giving customers the flexibility to pay for your products and services over time.

Mobile Wallet Payments: Make checkout lightning-fast for your customers by accepting Apple Pay and Google Pay directly on your checkout pages.

Advanced Affiliate Management

Wallet: We're introducing a secure balance system where PayKickstart can now manage and automate affiliate payouts for you, making it easier than ever to pay your partners.

Smarter Retention Tools

Cancellation Saver: Minimize churn and get valuable feedback from customers with customizable cancellation retention flows.

Social Proof: Reinforce trust and increase conversions by showing potential customers real-time pop-ups of recent purchases directly on your web pages.

… and so much more!

Ready to experience an all-in-one platform without limitations?

Every plan includes a 14-day free trial.

Log in and check out our new plans today!

August 16th, 2025

New Feature

Block Same IP

You can now prevent multiple purchases of your main product from the same IP address or range. This feature is perfect for protecting against a single user making repeated purchases, whether for fraud or to circumvent your terms of service. You have full control to define both the scope and duration of the block.

Define the Scope: Choose to block the exact IP address, or cast a wider net by blocking the entire Class C, Class B, or Class A subnet.

Define the Duration: Set the block to be permanent or temporary. For temporary blocks, you can specify a duration in minutes. The block will last until the original purchase is reversed if you leave the duration empty.

Require Company-Only Emails

For B2B vendors, this is a game-changer. You can now enable a powerful lead-filtering tool that blocks signups from free email services (like Gmail or Yahoo) and requires a valid company email address. This feature helps you:

Reduce Spam: Eliminate unqualified leads and fraudulent signups.

Improve Lead Quality: Ensure you're engaging with representatives from real businesses.

Boost Engagement: Focus your marketing efforts on high-quality B2B prospects.

You'll find these new settings under the Campaigns tab in your PayKickstart account. We're committed to giving you the tools to secure your business and maximize your success!

Block Failed Attempts

Protect your business from costly card testing abuse and fraudulent activities. You can now automatically block users after a set number of failed payment attempts, stopping bad actors before they can cause harm.

Block by Email or IP: Choose to block suspicious users by their email address or IP address to prevent further attempts.

Set Custom Thresholds: You have full control to define the number of failed attempts (e.g., 3 failures) and the time period (e.g., within 15 minutes) that will trigger a block.

Flexible Block Duration: Configure the block to be permanent or set a temporary duration for up to 24 hours.